Do You Really Need a New Phone?

Your phone feels like it’s running a marathon on one bar of signal — apps crawl, the battery taps out before lunch, and your once‑sharp photos now look like they were taken through a foggy window. The shiny new iPhone 17 or Samsung Galaxy S25 is calling your name like the latest gadget in a shop window, but with record‑high prices in the Philippines, is this upgrade a need or just a high‑tech craving?

Think of this article as your financial compass. It will help you:

- Diagnose whether your current phone truly needs replacing — no impulse swipes here.

- Discover the smartest, most cost‑effective ways to get your next device — including how to use the right credit card or financing plan — without blowing up your budget.

The Diagnosis – 5 Signs You’re Truly Due for an Upgrade

Use this checklist to know if it’s really time:

The Smart & Cost‑Effective Acquisition Plan

Once you confirm you do need an upgrade, here’s how to save money and get the most out of your purchase:

1. The Trade‑In Tactic: Offset the Cost

Check trade‑in values from Apple Philippines, Samsung, Globe, Smart, and third‑party buyback sites. Clean your phone and include original box/accessories for better valuation.

2. Buying Refurbished: A Hidden Gem

Certified refurbished phones are tested, repaired, and often come with a warranty — but cost much less. Local sites like CompAsia offer good‑as‑new devices with installment plans.

3. Older Flagships & Mid‑Range Marvels

Last year’s iPhone or Samsung flagship often gets a price cut when the new model drops. Mid‑range phones now have 90% of flagship features (5G, multi‑lens cameras, fast charging) at half the price.

4. Timing Your Purchase

Watch for sales like 11.11, 12.12, or back‑to‑school promos. Right after a new launch (like the iPhone 17 this September), previous models become more affordable.

5. Payment Smarts: Credit Card Perks & Loans

If buying outright, use a credit card with 0% installment plans or cashback to spread the cost and earn rewards. Finmerkado features updated credit card comparisons to help you find a card that fits your budget and maximizes rewards on big‑ticket purchases.

If cash flow is tight but you’ve confirmed the upgrade is necessary (for work or school), a small personal loan can be a responsible option — better than resorting to payday loans with high interest. Finmerkado partners with lenders who offer fast, transparent personal loans.

Pre‑Upgrade Checklist

Here’s your Pre‑Upgrade Checklist before you sell, trade in, or pass down your old device:

- Back up photos and files. Use Google Photos, iCloud, or an external hard drive to make sure your memories and important documents don’t vanish with your old phone. Think of it as packing up your digital house before moving out.

- Remove SIM and microSD cards. Your SIM holds your number and some contacts, and your microSD might store sensitive files. Taking them out prevents anyone else from accessing your personal info — and ensures you can pop them into your new phone right away.

- Sign out of Apple ID or Google account. This step protects you from activation lock issues and keeps your data secure. Many buyers and trade‑in programs won’t accept a phone that’s still tied to an account.

- Perform a factory reset. Wipe your phone clean so none of your passwords, messages, or photos remain. It’s like handing over a blank slate to the next owner, good for privacy and for getting the best resale value.

Conclusion

Upgrade Smart, Not Stressed

The goal isn’t to own the newest phone — it’s to own the right phone for your life and budget. By using this checklist and following these strategies, you can save thousands of pesos and still enjoy smooth performance.

Finmerkado can help you make that decision easier — from comparing credit cards with 0% installment offers to finding personal loan options to cover the gap. Upgrade wisely, keep your budget intact, and enjoy the phone that truly meets your needs.

References:

- Apple Philippines – Trade‑In Program

- CompAsia PH – Certified Refurbished Devices

- EndOfLife – iPhone Support Tracker

- Consumer Reports – Refurbished Phone Buying Guide

Frequently Asked Questions

Most iPhones get 5–7 years of iOS updates. High‑end Androids usually get 3–5 years. Check your model on endoflife.date.

Yes, if you buy from a certified source with warranty. Avoid random sellers without return policies.

If the phone’s performance is still good, battery replacement can extend its life for a fraction of the cost.

Right after a new launch or during sale events like 11.11 or 12.12, when older models drop in price.

Carrier plans offer low upfront cost but may be pricier over time. Buying outright with a 0% credit card installment often saves money long‑term.

UnionBank offers accounts, loans, credit cards, and investments to meet varied customer demands. The bank makes banking transactions easy with years of knowledge and a large branch network around the Philippines.

BPI offers many financial options for varied purposes. BPI offers personal, commercial, investment, and credit products and services to meet various financial needs. This makes financial management easier for individuals and organizations by providing a one-stop banking solution.

BPI Amore Platinum Cashback Card

- Get 4% cash back on dining and online delivery spend

- Get 1% cash back on supermarkets and department store spend

- Earn up to 0.3% cash back on other international and local retail spend

- Enjoy exclusive perks and deals at any Ayala Malls nationwide

- One of the lowest forex conversion rates at 1.85%

- Ideal for people who enjoy shopping while saving

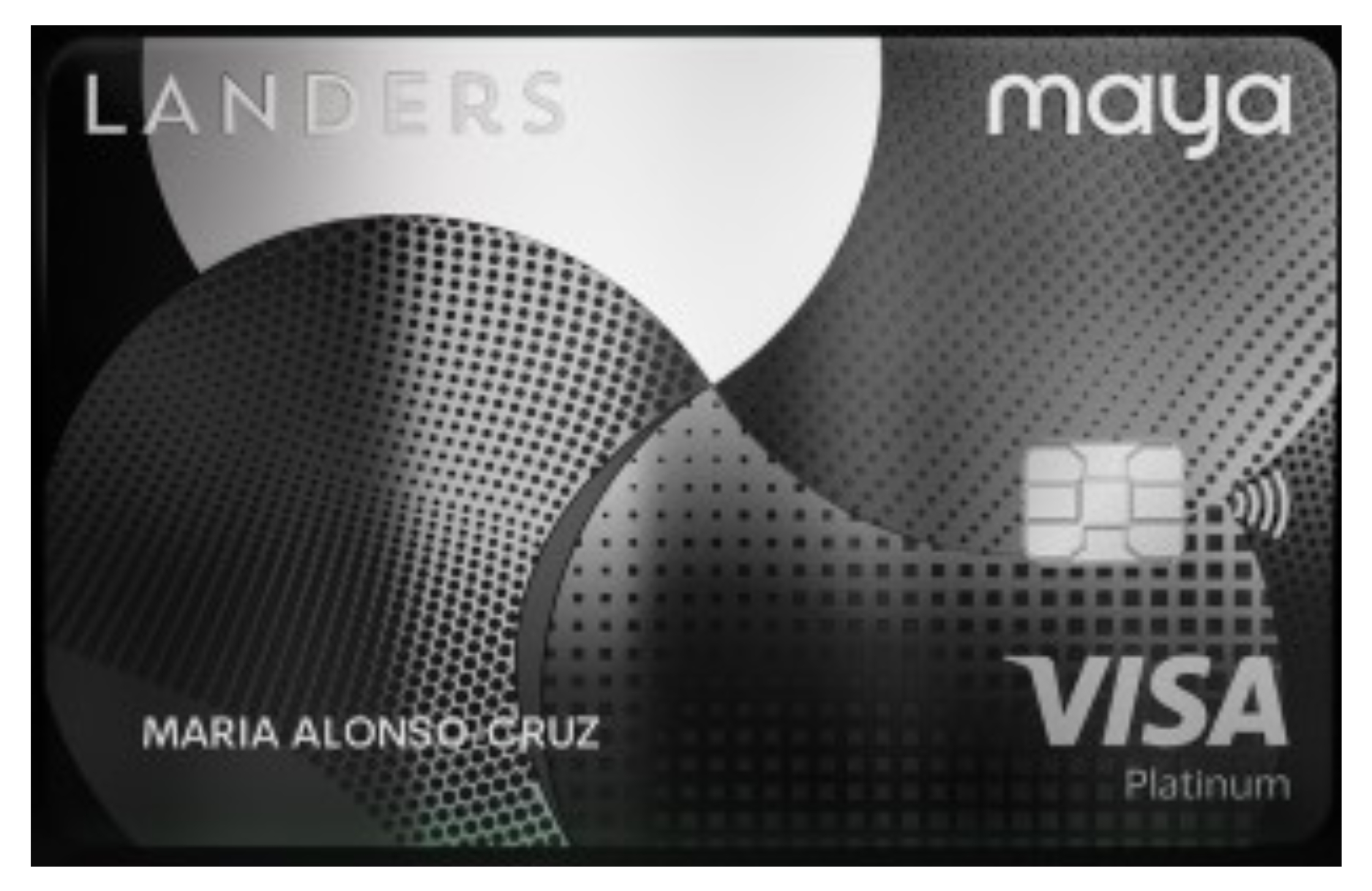

Maya Landers Cashback Credit Card

- No annual fee with just one monthly transaction

- Earn up to 5% cashback at Landers on in-store and online purchases

- Get 2% cashback on dining and 1% cashback on other local or international spends.

- Exclusive Landers perks—enjoy discounts, promos, and store access with your membership.

- Complete in-app control—freeze/unfreeze, view transactions, manage limits, and redeem cashback instantly.

BDO Unibank Personal Loan

BDO Unibank’s Personal Loan offers unsecured financing of up to ₱2 million with a fully digital or branch-assisted application process. It’s an accessible cash option for immediate needs like debt consolidation, travel, events, and other lifestyle expenses. With competitive rates starting at 0.98% monthly add-on and flexible repayment up to 36 months, it’s a solid choice for salaried and self-employed individuals.

BPI Personal Loan

Need a cash boost for life’s big moments or unexpected emergencies? The BPI Personal Loan offers a reliable and flexible solution—whether you’re funding a small business, covering tuition, or consolidating debt. With competitive rates, fixed monthly payments, and a fast approval process, this loan is designed to fit your goals and your lifestyle. No collateral required, just straightforward access to funds when you need them most.

PNB Personal Loan

The PNB Personal Loan offers unsecured, flexible financing of up to ₱2 million with low introductory add‑on interest rates starting at around 1% monthly. This translates into a starting APR around 12%, though actual rates can vary depending on borrower risk profile and loan tenure. With repayment terms from 3 to 60 months, it’s ideal for personal goals such as renovation, events, education, or debt consolidation. Fully digital or branch‑assisted application options make it accessible and convenient.