Your commute is changing — and your wallet needs to keep up.

If you ride the MRT, tap a Beep card, or pay tolls with RFID, you’re already part of the biggest financial shift in Metro Manila’s daily life. Between 2024 and 2026, the Philippines quietly rolled out one of Southeast Asia’s most aggressive cashless transportation ecosystems — and most commuters don’t realize how much it’s reshaping their money habits.

From credit cards now accepted on MRT-3 to QR payments on buses and RFID-only expressways, transportation is no longer just a travel cost. It’s becoming a financial data stream that affects your budgeting, credit score, rewards, and security.

Here’s what the new digital commute means for your wallet — and how to turn it into a financial advantage.

The Digital Payment Revolution in Manila Transport

Manila’s payment transformation didn’t happen overnight. It arrived in waves:

- 2024 – MRT-3 began accepting contactless credit and debit cards

- 2024–2025 – Beep card expanded into buses, modern jeepneys, ferries, and some retail

- 2025 – Expressways enforced RFID-only tolling

- 2025–2026 – QR payments rolled out across buses, ferries, and terminals

Today, a single commute might use:

- A credit card for the MRT

- A Beep card for a jeepney

- RFID for Skyway

- GCash for a bus or ferry

Your transportation spend is now fragmented across platforms, each with different fees, rewards, and risks.

What This Means for Your Daily Expenses

Cash vs Digital: The Real Cost

Cash used to be simple. Now, every digital tap creates:

- A merchant category

- A transaction fee

- A reward or penalty

Some cards treat MRT rides as transport spending (earning points).

Others treat them as miscellaneous charges (earning nothing).

Some wallets charge cash-in fees.

Some RFIDs charge reload fees.

Those “small” differences can add up to ₱500–₱1,500 per year just from commuting.

The Cashless Spending Trap

Psychologically, cashless payments feel painless.

You don’t “see” money leaving — so you’re more likely to:

- Take toll roads

- Ride premium transport

- Skip walking or cheaper options

Digital convenience can quietly inflate your transport budget.

Credit Card Opportunities in Transportation

This is where Finmerkado shines.

Many Philippine credit cards now:

- Recognize transport as a reward category

- Apply contactless multipliers

- Offer commute-related insurance

Why your daily commute is a credit-building machine

A ₱150 MRT ride × 2 trips × 22 workdays = ₱6,600 per month

That’s:

- Regular

- Predictable

- Perfect for credit history

Paying it off monthly improves:

- Credit score

- Credit limit

- Future loan approval

Your ride to work can literally unlock better financial products.

Mobile Wallet Integration Strategies

GCash dominates Manila transport, but how you fund it matters.

Smart move:

Use credit cards for MRT + tolls, GCash for buses + jeepneys, and set auto-reload thresholds so you never get stranded.

The Multi-System Challenge

You’re no longer managing one transport wallet. You’re managing:

- Beep

- RFID

- Credit cards

- GCash / Maya

This creates:

- Blind spots in budgeting

- Missed rewards

- Duplicate balances

Use:

- Card apps for credit spend

- GCash transaction logs

- RFID statements

Or one Finmerkado-recommended expense tracker to see the whole picture.

Financial Planning for the New Normal

Your transport spending now affects:

- Credit utilization

- Emergency funds

- Tax deductions (for freelancers and business travelers)

If your average commute is ₱8,000/month, that’s:

- ₱96,000 per year

That’s not “small money” — it’s a financial category that deserves strategy.

Future-Proofing Your Wallet

What’s coming next:

- Interoperable wallets

- Central bank digital peso

- One-tap payments across all transport

- International card acceptance

The winners will be people who already have:

- Strong credit

- Reward-optimized cards

- Clean digital records

Practical Setup Guide

Every Manila commuter should have:

- 1 main rewards credit card

- 1 backup card

- GCash or Maya

- Active RFID

- Beep card

Enable:

- Transaction alerts

- Spending limits

- Auto-reloads

Common Pitfalls

Avoid:

- Foreign transaction fees on transit terminals

- Dynamic currency conversion

- Expired card failures

- No-balance RFID

Always keep a backup payment.

Maximizing Benefits Across Systems

You can stack:

- Credit card cashback

- GCash promos

- RFID rebates

- Seasonal transport discounts

This can turn a ₱8,000 commute into ₱600–₱1,000 in savings.

Security & Protection

Modern contactless payments are:

- Tokenized

- Insured

- Trackable

Better than carrying cash — if you use alerts and card controls.

Who Benefits Most

- Students build credit

- OFWs use global cards

- Seniors get safer payments

- Business travelers get deductions

- Daily commuters earn rewards

Conclusion

Your Commute Is Now a Financial Tool

Manila’s shift to cashless transportation didn’t just make commuting faster — it turned every ride into a financial decision. From MRT contactless payments to RFID tolls and QR-powered buses, your daily travel now affects your credit score, rewards, spending habits, and even your long-term financial flexibility. When managed correctly, your commute can help you earn cashback, build credit, and stay in control of your money instead of quietly draining it. That’s why now is the perfect time to review your credit cards, optimize your mobile wallets, and align your transportation setup with your financial goals. With the right tools and strategy, every tap, swipe, and ride can move you closer to smarter, more secure finances — and Finmerkado is here to help you make every trip count.

Frequently Asked Questions

Yes. MRT-3 now accepts contactless credit and debit cards, allowing you to tap and go without buying tickets or topping up Beep cards.

It depends. Credit cards often earn rewards and help build credit, while GCash offers convenience and promos for buses, jeepneys, and ferries.

Yes. Regular transport spending paid on time through a credit card creates a positive payment history and improves your credit profile.

Some wallets charge cash-in or reload fees, and some cards apply foreign or processing fees. Always check your card and wallet terms.

Use your credit card app, GCash transaction history, and RFID portals — or consolidate everything using a Finmerkado-recommended expense tracker.

Offers a rapid online application process that takes minutes, ensuring quick approval and fund transfers to returning customers' bank accounts.

At UNO Bank, we prioritize speed and efficiency. Our streamlined online application process is designed to take only minutes, ensuring you can quickly move from application to approval. Once approved, funds are swiftly transferred to your bank account, demonstrating our commitment to fast service, especially for our valued returning customers.

Metrobank M Free Card

- NO annual fee for life

- NO minimum spent requirement

- Worldwide acceptance 0% installment programs

- Exclusive Promotions and Offers

- Ideal for those looking to maximize financial control and convenience

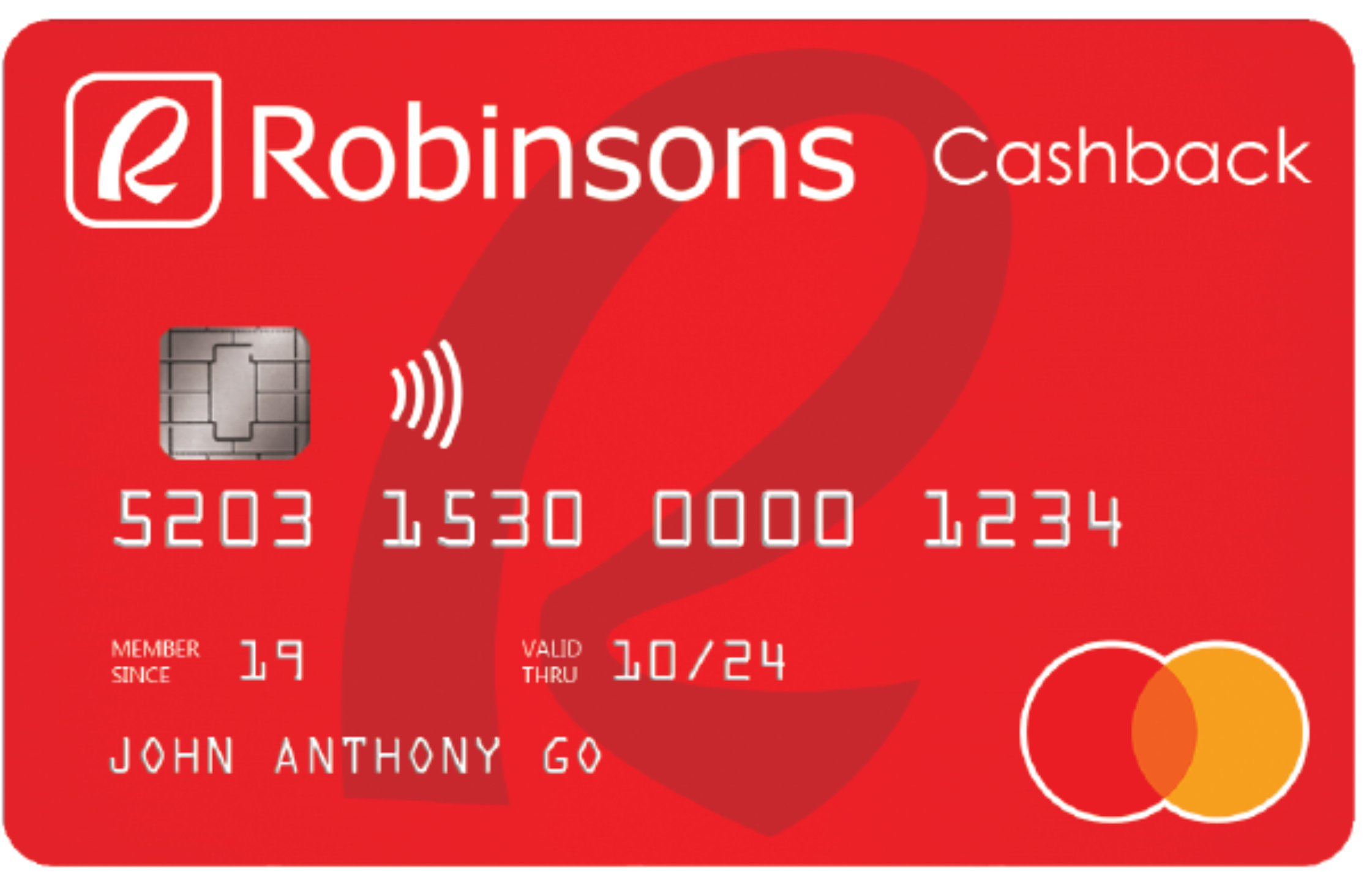

Robinsons Bank Credit Card

-

HSBC Premier Mastercard

BDO Unibank Personal Loan

BDO Unibank’s Personal Loan offers unsecured financing of up to ₱2 million with a fully digital or branch-assisted application process. It’s an accessible cash option for immediate needs like debt consolidation, travel, events, and other lifestyle expenses. With competitive rates starting at 0.98% monthly add-on and flexible repayment up to 36 months, it’s a solid choice for salaried and self-employed individuals.

BPI Personal Loan

Need a cash boost for life’s big moments or unexpected emergencies? The BPI Personal Loan offers a reliable and flexible solution—whether you’re funding a small business, covering tuition, or consolidating debt. With competitive rates, fixed monthly payments, and a fast approval process, this loan is designed to fit your goals and your lifestyle. No collateral required, just straightforward access to funds when you need them most.

CIMB Personal Loan

Fully digital, unsecured personal loan with fast approval and disbursement. Ideal for emergencies, business needs, or lifestyle goals.