The Ultimate Balancing Act

Being a self-funded student feels like walking a tightrope with textbooks in one hand and a shift schedule in the other—while still waving to your family from below. It’s not just a test of intelligence, but of endurance, grit, and timing.

Whether you're working a café shift, cramming for a quiz, or managing a household, every day feels like you're racing through a marathon with multiple finish lines and time constraints. And when even a single missed bill, like a credit card due date or tuition deadline, can throw everything off balance—you realize just how much precision and planning this lifestyle demands.

This guide is for students doing the impossible every single day. We'll break down how to manage your time, money, mental space, and relationships—without letting one drop while you juggle the rest and keep your physical and mental health in check.

Time Budgets: Create a Master Calendar That Works

To manage your time effectively, you need to visualize it. A weekly schedule that breaks down your available hours helps you understand how much time goes into each task—and how much is left. A lot of times stress results from poor time management. Here's a guide on how to effectively manage your time.

Sample Time Budget Table

Pro time management tip: Use a master calendar to map out your important tasks for each week. Tools like Google Calendar or Trello can help you stay organized.

Financial Tracking: Know Where Your Money Goes

When you're a self-funded student, every peso has a purpose. That ₱500 could mean one less subject to retake—or one emergency ride home from a night shift.

Track your money using these basic steps:

- List all income sources: part-time job, side hustles, family contributions, scholarships

- Break down essential expenses: tuition, books, transport, food

- Set aside for emergencies and school fees

- Avoid “invisible leaks” like excessive online shopping or late payment penalties

You can use free budget apps like Spendee or Money Manager to help track income and expenses.

According to financial wellness advocates, budgeting early gives self-funded students greater peace of mind—and helps prevent burnout during exam weeks or practicum.

Priorities and Boundaries: You Can’t Do Everything (At Once)

When everything feels urgent, nothing truly gets done. That’s why having a priority grid helps separate the noise from the necessary.

Eisenhower Matrix Example

Use this to decide:

- What needs your focus right now

- What you can schedule for later

- What tasks to delegate, postpone, or say no to

Saying “no” to one thing often means saying “yes” to your mental health.

Self-Care Isn’t Optional — It’s Survival

Running on empty? That’s a one-way ticket to burnout.

Make time for self-care without guilt:

- Schedule short breaks between classes or shifts

- Use breathing exercises or apps like Insight Timer

- Talk to your support system—even 10-minute check-ins with friends or mentors help

- Sleep. Seriously.

As emphasized by MentalHealthPH, a supportive environment is key to thriving in tough academic and work conditions. You’re not weak for needing rest—you’re wise for preventing breakdowns before they happen. Self discipline is the key.

Real-Life Spotlight: Ana, the Student-Mom Who Found Her Rhythm

Ana, 24, is a working student and single mom from Davao. Her mornings start at 5 AM prepping her child for daycare. By 7, she’s in class. At noon, she’s working a shift at a local café, and by 9 PM, she’s reviewing for her bachelor’s degree in Business Admin.

How does she do it?

Ana uses a color-coded planner, meal preps on weekends, and—most importantly—asks for help. “I used to think doing it all meant doing it alone,” she shares. “Now, I know balance means knowing when to push and when to pause.”

She sets time limits on social media, keeps a Sunday family schedule, and tracks every peso she earns and spends. Her long-term dream? Opening a small coffee cart once she finishes school.

Free Tools & Templates for Self-Funded Students

Here are some useful resources to stay organized and sane:

- Free Priority Grid Template (Canva)

- Smarsheet Google Sheets Weekly Planner Templates

- TESDA Online Programs for free upskilling

- Notion for all-in-one to-do lists and study habits

Conclusion

Final Thoughts

Life as a self-funded student isn’t just a balancing act—it’s a full-blown circus, where you’re the ringmaster, acrobat, and ticket-seller all at once. But here’s the truth: you don’t have to pull off every stunt alone especially if you're balancing school, work and other things.

With the right systems, support, and tools, you can turn your chaotic schedule into a working rhythm—one that doesn’t just help you survive the semester but sets you up for long-term success. The secret lies in knowing when to leap, when to rest, and when to ask for a net.

And when you’re ready to sharpen your routines, manage your budget like a pro, or explore credit card strategies that align with your student goals, Finmerkado is here. We’re not just a resource; we’re your safety harness for the climb.

References

- MentalHealthPH

- TESDA Online Program

- Spendee

- Money Manager App

- Insight Timer – Mental Wellness App

- Canva Matrix Templates

Frequently Asked Questions

Use a weekly schedule to visualize where your time goes. Schedule study sessions during low-energy hours at work or after class.

Use budgeting apps or a basic spreadsheet. Include all income and expenses and review it weekly.

Set clear expectations. Let them know your class or work hours, and schedule family time when you're most available.

You probably don’t—and that’s okay. Use time management strategies like priority grids and batching to focus on important tasks first.

If you’re always tired, anxious, or falling behind, that’s your cue. Check in with a friend, professor, or counselor. Prevent burnout by taking short breaks and reassessing your commitments.

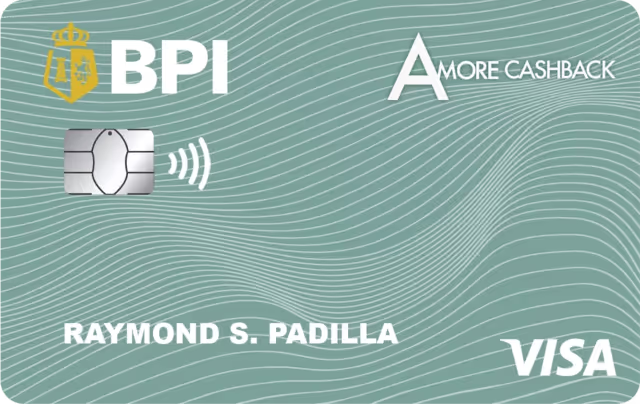

BPI offers many financial options for varied purposes. BPI offers personal, commercial, investment, and credit products and services to meet various financial needs. This makes financial management easier for individuals and organizations by providing a one-stop banking solution.

UnionBank offers accounts, loans, credit cards, and investments to meet varied customer demands. The bank makes banking transactions easy with years of knowledge and a large branch network around the Philippines.

BPI Amore Cashback Card

- Get up to 4% cash back on supermarkets and department store spend

- Get up to 1% cash back on drugstore and bills payment spend

- Earn up to 0.3% cash back on all other local retail spend

- Enjoy unlimited access exclusive customer and family lounges in Ayala Malls

- One of the lowest forex conversion rates at 1.85%

- Ideal for cardholders who love saving while shopping

Metrobank Titanium Mastercard

- No annual fees with a min. annual spend of ₱180K for new cardholders who apply until Aug 31, 2024

- Earn 2x points on online, department store and dining transactions

- Enjoy 1 never-expiring point for every ₱20 spent

- Experience exclusive benefits from Metrobank

- Ideal for shoppers focused on essential spending

UNO Bank Personal Loan

Whether you're aiming to grow your business, further your education, or embark on your dream vacation, an UNO Bank Personal Loan can assist you in reaching your life's aspirations.