Share your feedback

Enjoy double rewards with every online purchase and tailor your benefits to suit your lifestyle. Apply now to unlock unparalleled rewards with the Metrobank Rewards Plus Card!

- 2x reward points on all online, gadgets, telco, internet & mobile services and delivery transactions

- Earn 1 never-expiring point for every ₱20 spend

- Choose rewards that fit your style – from personal gadgets and gifts for the kids, to air miles and donations to a good cause

Eligibility

Required Documents (if applicable)

- Regular Employee: copy of the latest ITR duly stamped as received by the BIR or bank/copy of BIR Form 2316 signed by employer, or copy of last 3 months' payslip

- Existing Credit Cardholders with Other Bank: Latest Billing Statement with at least 9 months as a principal cardholder

- Active mobile number

- Must be a principal cardholder with another bank for at least 9 months with a credit limit of at least ₱25,000

- At least 6 months employed as a regular employee

Fees

Interest

Limits

Payment and Receiving Methods

Payment and Receiving Methods

Payment and Receiving Methods

Supported Payment Methods

Receiving Methods

Make the most of every transaction with the Metrobank Rewards Plus Card, the ideal partner for astute consumers and reward aficionados. Get double points for online purchases, and customize your perks to fit your needs. This card turns regular purchases into worthwhile endeavors.

Because it is accessible and just requires a yearly income of ₱180,000, it is a sensible option for a broad range of people. Rich rewards and cost-effectiveness are combined in the Metrobank Rewards Plus Card, which has an inexpensive annual charge of ₱2,500 and no issue fee.

This card's focus on customer-centric advantages is its main selling point. The rewards program enables you to maximize every peso spent, regardless matter whether you're a frugal or frequent internet shopper.

Take charge of your money and enjoy the benefits you are entitled to. To begin earning rewards catered to your individual tastes, apply for the Metrobank Rewards Plus Card right now.

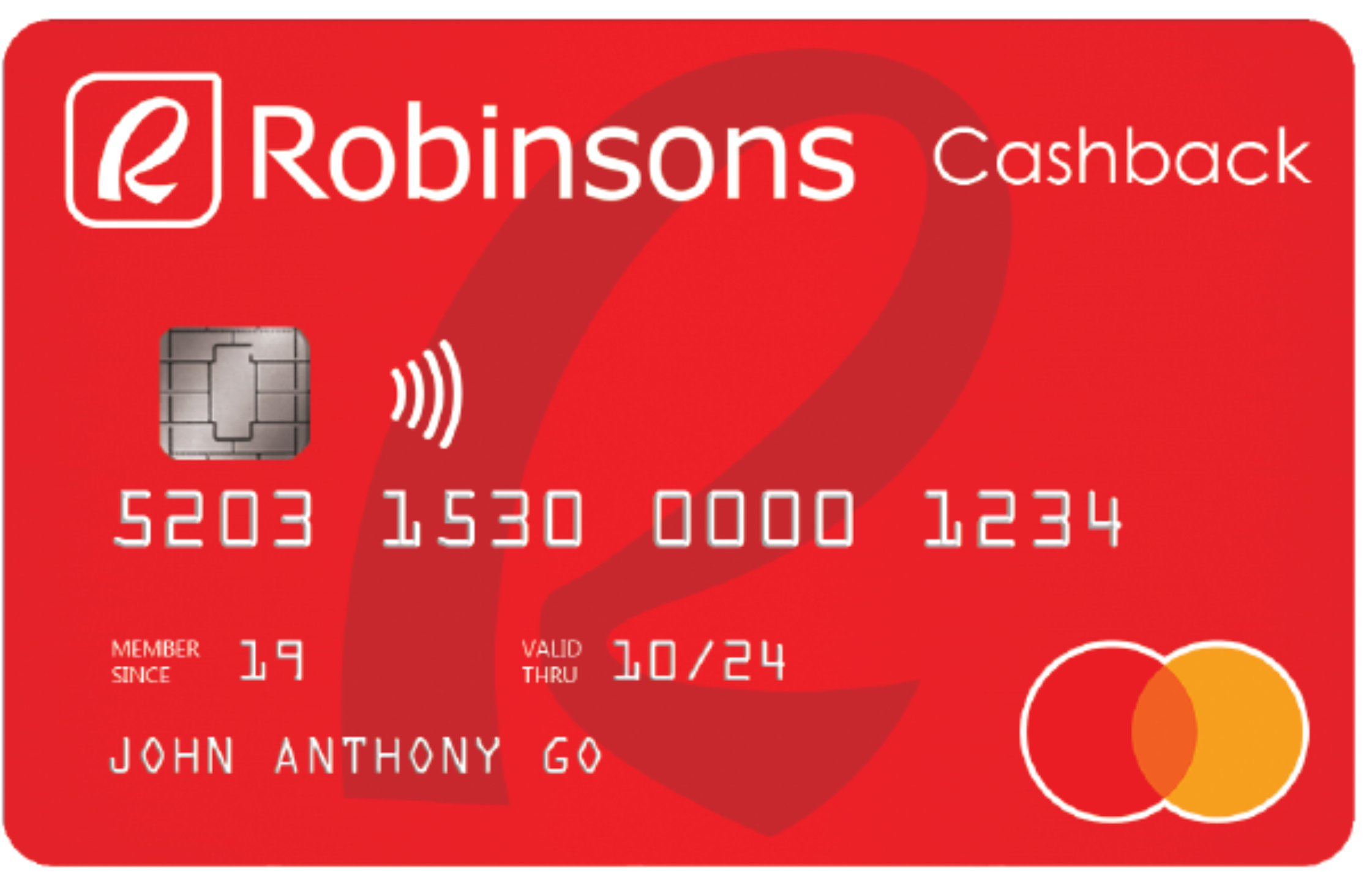

Robinsons Bank Credit Card

-

PNB-PAL Mabuhay Miles World Mastercard

Priority check-in at PAL Business Class counters; concierge services; lounge access

Metrobank Travel Platinum Card

- Exclusive welcome gift for New-to-Metrobank credit cardholders

- Earn miles quickly with the Metrobank Travel Platinum Card

- Receive 1 mile for every ₱17 spent on airlines, hotels, and foreign currency transactions

- Earn 1 mile for every ₱50 spent on other categories

- Triple rewards on local airlines, hotel accomodation and international spending

- Enjoy a FREE first supplementary credit card

- Ideal for frequent travelers looking to maximize their rewards

Frequently asked questions

The Metrobank Rewards Plus Card offers a balanced mix of rewards, flexibility, and convenience for individuals who want to earn points on everyday purchases and redeem them for valuable rewards.

Key Features:

Reward Points: Earn 1 reward point for every ₱30 spent on all eligible purchases.

Bonus Points: Enjoy additional points for specific categories like dining, groceries, and online shopping.

Flexible Redemption Options: Redeem points for airline miles, shopping vouchers, or statement credit.

Global Acceptance: Use the card anywhere Visa is accepted, offering both local and international purchasing power.

No Expiry of Points: Reward points do not expire, allowing you to accumulate them for larger rewards.

This card is ideal for individuals who want a straightforward rewards program with plenty of flexibility for redemption and long-term savings.

Earning and redeeming rewards with the Metrobank Rewards Plus Card is simple:

Earning Rewards:

Earn 1 reward point for every ₱30 spent on all eligible purchases, including dining, shopping, and online transactions.

Special bonus points on certain categories, including dining and groceries.

Redemption Options:

Airline Miles: Convert reward points into frequent flyer miles with airline partners.

Shopping Vouchers: Redeem points for gift certificates from various partner retailers and online stores.

Statement Credit: Use points to reduce your outstanding balance.

Charity Donations: Donate your points to charity partners.

How to Redeem:

Points can be redeemed through Metrobank Online Banking or the Metrobank Mobile App for a seamless redemption process.

To apply for the Metrobank Rewards Plus Card, applicants must meet the following requirements:

Age: At least 21 years old.

Income: Minimum annual income of ₱180,000.

Residency: Filipino citizen or resident foreigner with a valid Philippine address.

Required Documents:

Government-issued ID (e.g., passport, driver’s license).

Proof of income (e.g., payslips, ITR, Certificate of Employment).

Proof of residence (e.g., utility bills, bank statements).

This card is ideal for individuals who have a stable income and are looking for a simple rewards program with the flexibility to earn and redeem points.

The Metrobank Rewards Plus Card has the following fees:

Annual Fee: ₱2,000 (waived for the first year).

Supplementary Card Fee: ₱1,000 per supplementary card annually.

Late Payment Fee: ₱750 or the unpaid minimum amount due, whichever is lower.

Cash Advance Fee: ₱300 or 3% of the amount withdrawn, whichever is higher.

Foreign Transaction Fee: 2.5% of the converted transaction amount.

The first-year annual fee waiver makes it a great option for individuals looking for a rewards card with minimal upfront cost.

In addition to its rewards program, the Metrobank Rewards Plus Card provides a range of additional benefits:

Purchase Protection: Coverage against theft, accidental damage, or loss of eligible purchases made with the card.

Travel Insurance: Up to ₱10 million in coverage for travel accidents when tickets are purchased using the card.

Flexible Installment Plans: Convert large purchases into affordable monthly installments with low interest rates.

Exclusive Offers: Enjoy discounts and promotions from various merchants and dining establishments.

Global Emergency Assistance: 24/7 emergency services including card replacement, emergency cash, and travel assistance for cardholders worldwide.